#layer 1 blockchain list

Explore tagged Tumblr posts

Text

Top 5 AI Meme Coins for 2024

Explore the most promising AI-driven meme coins of 2024. We've curated a selection of top AI meme coins for you to consider investing in this year. Uncover their unique features and more in this article.

The AI Meme Coins Trend

Artificial intelligence (AI) is rapidly permeating various sectors, from technology to blockchain. This expansion into the crypto world has been notably well-received, bringing a fresh perspective to the market. AI's integration with meme coins is now captivating even the most experienced traders.

Unlike Dogecoin and Shiba Inu, which have faced substantial criticism, this emerging trend in AI meme coins is generating positive buzz and substantial excitement. Analysts believe that merging AI with meme coins could potentially transform the industry.

AI enhances user experience, scalability, and blockchain security, drawing significant interest from the crypto community. AI crypto tokens are now widely adopted for diverse applications such as portfolio management, decentralized marketplaces, and blockchain governance.

Let’s delve into the top five AI meme coins making waves in 2024:

1. BUSAI: A Panda Powered-Meme Project 2024

First and foremost, you can't overlook BUSAI, an innovative digital asset built on the Solana blockchain, distinguishing itself as a premier AI meme coin in 2024.

The project is designed to integrate artificial intelligence (AI) with blockchain technology, focusing on stimulating AI development and fostering creative content creation within a vibrant community. BUSAI’s unique approach and robust infrastructure position it as a promising investment opportunity this year.

Currently, the BUSAI community is buzzing with excitement and experiencing a FOMO frenzy due to numerous pre-listing projects, allowing everyone to hunt for tokens for free. Additionally, there are two presale rounds, offering a golden opportunity to purchase tokens at lower prices before the anticipated price surge upon listing.

2. Arbdoge AI: A Community-Driven Revolution

Arbdoge AI, the most ambitious project within the Arbitrum ecosystem, stands out for its community-centric approach. Unlike many other ventures, it is not funded by venture capitalists nor does it allocate shares to a specific team. Instead, all tokens are equitably distributed among community members, marking a bold move in the crypto space.

The dedicated team behind Arbdoge AI is committed to collaborating with the community to develop a comprehensive suite of products leveraging artificial intelligence and Web3 technology.

3. KAI: The Crypto Cat's Comeback

KAI, a former feline-themed cryptocurrency, is making a playful yet strategic return to challenge major market players. The project blends humor with real-world utility, offering staking rewards and business opportunities.

4. Byte: AI Memecoin With Cryptonote Protocol

Bytecoin leverages the Cryptonote protocol for private transactions, prioritizing user privacy. Transactions occur on a decentralized Bytecoin blockchain, enabling direct user-to-user transactions without intermediaries, maintaining participants' anonymity.

5. Turbo: Once an AI-Based Meme Coin for 2023

Turbo Coin is designed for rapid and seamless transactions, living up to its name with fast processing speeds within its blockchain network. The technology ensures scalability and quick transaction verification through an efficient consensus mechanism.

Turbo Coin may introduce the Lightning Network as a Layer 2 solution for real-time micropayments, enhancing speed and usability. In the competitive crypto market, Turbo Coin aims to provide a fast and reliable payment system for all users.

Source: Compiled

The BUSAI Official Channel: Website | Twitter | Telegram

1 note

·

View note

Text

Beyond Ethereum: Exploring Alternative Blockchains for NFT Minting in 2025

The Evolving Landscape of NFT Minting

The NFT minting landscape has grown far beyond Ethereum. Today, creators have access to faster, more affordable, and greener alternatives across different blockchains. With the rise of NFT development solutions and reliable options like Arweave NFT storage and Storj NFT storage, launching and securing digital assets has become easier. Whether you're working with an NFT development company or handling NFT platform development in-house, there's more flexibility and support than ever before. This new era allows artists, brands, and developers to explore the best NFT minting strategies across various networks, shaping a more accessible and dynamic NFT space.

1. XRPL: A Game‑Changer for NFT Creators

The XRP Ledger (XRPL) has quietly become a go‑to for many artists who want speed and low fees. Transactions settle in a few seconds, and minting costs are often only a fraction of a cent. For anyone wondering about file permanence, pairing XRPL with Arweave NFT storage means your artwork, metadata, and videos live on an immutable archive with no more broken links or lost files. If you prefer a decentralized cloud approach, Storj NFT storage shards and encrypts your media across thousands of nodes, giving you added resilience. Together, these tools make XRPL a simple, affordable choice for minting NFTs without the usual Ethereum headaches.

2. The Rise of Matic, Arbitrum, Avalanche, Hedera, and Binance Smart Chain

Layer‑2 solutions like Polygon (Matic) and Arbitrum have exploded in popularity because they inherit Ethereum’s security but slash gas costs. Avalanche offers near‑instant finality, while Hedera Hashgraph brings a unique gossip protocol that’s fast and energy‑efficient. Binance Smart Chain (BSC) rounds out the list with its broad user base and developer tools. If you’re hunting for NFT development solutions, these chains all boast robust ecosystems of smart‑contract libraries, SDKs, and cross‑chain bridges. That makes it easier for an NFT development company or a dedicated NFT minting development company to launch your project quickly, with ready‑built templates for tokens, marketplaces, and auctions.

3. Cost Efficiency: A Key Driver for Adoption

Unpredictable fees have long been the biggest barrier for new creators. Today, though, “best NFT minting” often means choosing the network with the lowest and most stable costs. On Matic and BSC, minting might only cost a few cents. Clever NFT minting development teams will bundle transactions, use meta‑transactions, or even let buyers cover gas in alternative tokens. And when it comes to file storage, Arweave’s one‑time payment model ensures you never face recurring bills for keeping your art safe. Alternatively, Storj NFT storage charges you only for the space and bandwidth you actually use, making it a lean option for projects of any size. By mixing efficient chains, smart batching, and cost‑effective storage, you can offer affordable drops that attract collectors without eating into your margins.

4. Navigating Growth and Risks in the NFT Market

Scaling a successful NFT project means balancing ambition with caution. A seasoned NFT development company can guide you through smart contract audits, performance testing, and upgradability strategies. Whether you need custom royalty splits, dynamic metadata, or a robust back end, their NFT platform development services cover everything from front‑end interfaces to off‑chain indexing. If you foresee big drops or unexpected user surges, partnering with an NFT minting development company ensures your infrastructure holds up. Diversifying across multiple chains—each supporting unique token standards—also helps you reach new audiences and guard against network hiccups. Finally, never underestimate the power of transparency. Clear roadmaps, published audit reports, and straightforward user guides build trust, which is vital for long‑term success in this fast‑evolving space.

Embracing a New Era of NFT Minting Beyond Ethereum

As NFT minting moves past Ethereum’s early dominance, creators now enjoy more choice, lower costs, and greater speed across a variety of networks. By tapping into chains like XRPL, Polygon, Avalanche, and Hedera and pairing them with reliable Arweave or Storj NFT storage, artists can launch tokens without high fees or long waits. Whether you partner with an experienced NFT development company or explore DIY NFT blockchain development kits, this new era puts flexibility and affordability front and center, empowering everyone to bring fresh digital creations to life.

Conclusion

The world of NFTs has grown far beyond Ethereum’s crowded corridors. Whether you choose the rapid settlement of XRPL with Arweave NFT storage, the cost‑friendly lanes of Matic and BSC, or the novel architectures of Hedera and Avalanche, you now have more control over speed, fees, and resilience than ever before. By engaging expert NFT development solutions, be it through an all‑in‑one NFT platform development partner or a specialized NFT minting development company, you’ll tap into best practices, secure storage with Storj NFT storage, and custom tooling that fits your vision. Embrace these diverse networks and services to craft unforgettable digital experiences, expand your collector base, and step confidently into the next chapter of NFT blockchain development.

#NFT development solutions#NFT platform development#NFT development company#NFT minting development#NFT minting development company#NFT blockchain development

0 notes

Text

Top 10 Cryptos To Invest In May 2025: Smart Choices for the Future

The top 10 cryptos market is constantly evolving, offering new opportunities for investors. As we enter May 2025, the digital asset landscape is more diverse and promising than ever. With increasing adoption, technological advancements, and institutional interest, cryptocurrencies are becoming integral to the global financial system.

This article will explore 10 promising cryptocurrencies that deserve your attention this month. These projects stand out due to their real-world use cases, community strength, and future growth potential.

1. Bitcoin (BTC)

Category: Digital Gold | Market Cap Leader

No list is complete without Bitcoin. As the cryptocurrency pioneer, Bitcoin remains the most trusted and widely adopted crypto asset globally. Despite market volatility, Bitcoin has proven its ability to recover and outperform traditional holdings over time.

Why Invest?

Store of value (digital gold)

Institutional interest keeps rising.

Supply capped at 21 million BTC.

Accepted by major companies and payment processors

Ideal for: Long-term holders and safe-haven seekers.

2. Ethereum (ETH)

Category: Smart Contracts & DeFi

Ethereum has transitioned to a proof-of-stake model (Ethereum 2.0), improving its scalability and energy efficiency. It remains the leading platform for decentralized applications (dApps), DeFi, and NFTs.

Why Invest?

Largest smart contract ecosystem

Ongoing upgrades (Danksharding & EIP developments)

High developer activity and ecosystem expansion

Ideal for: Investors who believe in Web3 and decentralized finance.

3. Solana (SOL)

Category: High-Speed Layer-1 Blockchain

Solana offers speedy transaction speeds with very low fees. It's gaining popularity for dApps, gaming, and DeFi projects.

Why Invest?

Fast and scalable blockchain

Strong developer support

Expanding ecosystem of apps and platforms

Ideal for: Investors looking for fast, scalable alternatives to Ethereum.

4. Polygon (MATIC)

Category: Ethereum Scaling Solution

Polygon is a Layer-2 scaling solution for Ethereum, making transactions faster and cheaper. It's partnered with major brands like Meta, Nike, and Reddit.

Why Invest?

Boosts Ethereum's scalability

Trusted by global enterprises

Eco-friendly and fast-growing

Ideal for: Ethereum believers who want cheaper alternatives.

5. Chainlink (LINK)

Category: Oracle Network

Chainlink provides reliable data feeds to smart contracts. From DeFi to insurance, Chainlink oracles help blockchains interact with real-world data securely.

Why Invest?

Real-world utility in DeFi and enterprise systems

Massive number of integrations and partnerships

Strong long-term roadmap

Ideal for: Investors interested in infrastructure-level crypto projects.

6. Arbitrum (ARB)

Category: Ethereum Layer-2 Rollup

Arbitrum is a fast-growing Ethereum Layer-2 rollup solution. It helps reduce congestion and gas fees on the Ethereum mainnet.

Why Invest?

A large share of the Ethereum L2 ecosystem

Rapid DeFi adoption

Low gas and faster transactions

Ideal for: DeFi-focused investors.

7. Avalanche (AVAX)

Category: High-Speed Blockchain Platform

Avalanche is a scalable blockchain platform used for dApps and enterprise blockchain solutions.

Why Invest?

Subnet technology supports custom blockchains.

High throughput (4500+ TPS)

Growing DeFi and GameFi sectors

Ideal for: Developers and investors who want scalability without compromising decentralization.

8. XRP (Ripple)

Category: Global Payments & Remittances

Ripple's XRP token is designed for real-time cross-border payments. It has strong use cases with banks and financial institutions.

Why Invest?

Fast and low-cost international payments

Legal clarity improving post-lawsuit

Strong institutional partnerships

Ideal for: Investors focusing on fintech and cross-border transactions.

9. UPB Token (Universal Payment Bank)

Category: Financial Ecosystem Token (Emerging Gem)

Though emerging, the UPB Token is quietly making waves in the financial sector. Positioned as a next-generation financial utility token, UPB offers solutions like banking services, lending, remittances, insurance, trading, payment gateway systems, and even asset protection — all under one decentralized platform.

Why Watch This Token?

It aims to replace traditional banking systems with blockchain-powered alternatives.

Multi-utility use case across payments, cards, lending, and insurance.

Combines features of existing giants like XRP, Ethereum, and traditional finance.

It is ideal for everyday financial activities powered by a single crypto asset.

While still under the radar, early adopters and savvy investors closely observe UPB's growth due to its real-world relevance and financial utility.

Ideal for: Long-term investors looking to get in early on a potentially revolutionary financial platform.

10. Cardano (ADA)

Category: Academic & Peer-Reviewed Blockchain

Cardano is a proof-of-stake blockchain developed with a research-driven approach. It focuses on security, sustainability, and scalability.

Why Invest?

Scientifically built architecture

Growing DeFi, NFT, and innovative contract ecosystem

Environmentally friendly

Ideal for: Investors who value academic and technical excellence in blockchain.

🌐 Tips Before You Invest in Crypto (Especially in 2025)

The crypto market is maturing, but it's still volatile. Before investing:

Do thorough research (DYOR)

Invest only what you can afford to lose.

Diversify your portfolio

Use cold wallets for long-term storage.

Keep track of regulatory changes.

🧠 Final Thoughts: A Balanced Strategy

While dominant players like Bitcoin and Ethereum are relatively safer bets, emerging tokens like UPB Token can offer exponential returns if their use case aligns with market needs — which UPB targets.

A smart portfolio in May 2025 might include:

40% BTC + ETH

30% Smart contract & utility platforms (SOL, MATIC, ADA, AVAX)

20% Infrastructure & payment solutions (LINK, XRP, ARB)

10% emerging tokens like UPB with high real-world use potential

📈 Ready to Explore the Future of Finance?

Investing in cryptocurrencies is no longer just a trend — it's becoming the new normal. From store-of-value coins to utility-driven financial platforms like UPB, May 2025 has promising opportunities. Whether you're a cautious investor or a risk-taker, the right mix of assets can prepare your portfolio for the next bull cycle.

#UPB #UPBtoken #upbonline #CryptoBank #CryptoBanking #cryptoPayment #CryptoUPI #upbcoin #universalpaymentbank #bitncoin #xrp #ethererum

Visit here:- www.tumblr.com

0 notes

Text

Invest in These 5 Coins Today and Change Your Fortune UPB Coin Included

In the fast-moving world of cryptocurrency, timing is everything. Those who invest in the right coins at the right time often find themselves on a completely new financial path. If you're ready to take that first step toward a brighter future, today is the perfect day to begin.

In this blog, we’ll highlight 5 powerful cryptocurrencies you should consider investing in right now – and yes, UPB Coin is proudly on this list. These coins offer great potential for growth and could be the key to transforming your fortune.

🌟 1. Bitcoin (BTC) – The King of Crypto

Bitcoin is the original and still the most powerful cryptocurrency. Known as “digital gold,” BTC has consistently proven its strength in the market and remains the most trusted asset among investors.

Why invest?

Limited supply (21 million)

Highly liquid

Long-term store of value

Even during market downturns, Bitcoin tends to recover and grow stronger, making it a solid foundation for any portfolio.

🚀 2. Ethereum (ETH) – The Backbone of Decentralized Finance

Ethereum goes beyond just currency – it powers smart contracts, decentralized apps (DApps), NFTs, and much more. With the transition to Ethereum 2.0, the network is becoming faster, more energy-efficient, and ready for mass adoption.

Why invest?

Supports a massive ecosystem

Real-world utility

Strong developer community

Ethereum is considered the go-to platform for innovation in the crypto space.

💰 3. UPB Coin (UPB) – The Rising Star of Crypto Banking

UPB Coin, from Universal Payment Bank (UPB), is a next-gen cryptocurrency designed for secure, fast, and seamless digital banking. It's not just another coin – it powers an entire ecosystem including Crypto UPI, international transfers, and merchant payments.

Why invest?

Backed by a growing fintech platform

Real-world payment use cases

Early-stage opportunity = high growth potential

With features like Crypto UPI and merchant adoption, UPB Coin is making crypto practical for daily use. It's one of the most promising coins to watch right now.

🔥 4. Solana (SOL) – The Speed Champion

Solana is known for being ultra-fast and low-cost, making it ideal for DeFi and NFT platforms. It can process 65,000+ transactions per second, which makes it one of the fastest blockchains available.

Why invest?

Low transaction fees

Strong developer adoption

Scalable for mainstream usage

As more projects choose Solana, its value is expected to surge.

💎 5. Polygon (MATIC) – Ethereum’s Layer 2 Solution

Polygon provides scalability to Ethereum by reducing gas fees and increasing speed through its Layer 2 technology. It’s already being used by big projects and has backing from major players in the industry.

Why invest?

High utility in Ethereum ecosystem

Lower fees and faster transactions

Partnered with big brands (e.g., Meta, Nike)

MATIC is essential for the future of Web3, and its real-world integration is already underway.

🎯 Final Thoughts

If you’ve been waiting for the “right time” to enter crypto – this is it. These 5 coins represent security, innovation, and growth potential, making them ideal for both beginners and experienced investors.

Whether you're looking for stability (BTC), utility (ETH), speed (SOL), scalability (MATIC), or the next big thing in crypto banking (UPB Coin) – now is your moment.

✅ Start Now – Don't Miss the Wave

📌 Research, invest smartly, and always diversify. But remember:

Fortune favors the bold – and those who act at the right time.

0 notes

Text

Build a Crypto Exchange Platform: Features, Cost, and Timeline

Introduction to the Crypto Exchange Craze

Cryptocurrency is no longer just a buzzword—it’s a booming industry. From Bitcoin to altcoins, the demand for trading digital assets has skyrocketed. If you’ve been thinking about diving into this space, building a crypto exchange platform might just be your golden ticket.

But hold on—what does it really take to build a platform like Binance or Coinbase? In this guide, we’ll walk through everything: features you need, how much it’ll cost, how long it’ll take, and the juicy bits in between.

Why You Should Build a Crypto Exchange Platform

The Rising Demand for Digital Currency

Let’s face it—crypto is here to stay. With millions of users and trillions in market value, the appetite for a secure and reliable trading platform is only growing. People want in, and they need platforms to help them get there.

Profitable Business Model

Transaction fees, listing fees, and premium features—just a few ways your exchange can generate revenue. And unlike traditional finance, crypto runs 24/7. That means your income doesn’t sleep.

Types of Crypto Exchanges

Before jumping in, it’s important to choose the right exchange model that aligns with your vision.

Centralized Exchange (CEX)

These are run by companies that manage users’ funds. Think of Coinbase. Easy to use, but you’re responsible for a lot—including security.

Decentralized Exchange (DEX)

No central authority. Traders use smart contracts to execute deals. It’s safer in terms of custody but can be complex for users.

Hybrid Exchange

A combo of both. You get the user-friendliness of a CEX with the security of a DEX. Best of both worlds? Possibly.

Key Features of a Crypto Exchange Platform

A successful platform isn’t just a trading page—it’s an entire ecosystem. Here’s what it must include:

User Registration and Verification

Your users should register easily. Include email/phone verification and secure sign-up options.

Secure Wallet Integration

Hot wallets for instant access and cold wallets for safer storage. Multi-signature wallets are a plus.

Trading Engine

This is your heartbeat. It matches buy/sell orders and handles pricing and execution in milliseconds.

Admin Panel

To control operations, users, fees, listings—you name it. A robust backend makes your life a whole lot easier.

Liquidity Management

Without liquidity, users can’t trade efficiently. Integrate with external liquidity providers if needed.

Multi-Currency Support

Support for Bitcoin, Ethereum, and multiple altcoins makes your exchange more versatile.

Real-Time Analytics

Let users view their portfolio, market movements, and historical data on the fly.

KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are a must in most regions.

Two-Factor Authentication (2FA)

Security should never be optional. 2FA adds a much-needed layer to prevent hacks.

Step-by-Step Process to Build a Crypto Exchange

Let’s break down the journey:

Step 1: Market Research and Planning

Understand your target audience. Do you want to serve advanced traders or crypto newbies?

Step 2: Legal Framework and Licensing

Check regional regulations. You may need licenses depending on where you operate.

Step 3: Choose the Right Development Approach

Custom development? White-label solutions? Decide based on budget, timeline, and scalability.

Step 4: UI/UX Design

Clean, intuitive interfaces convert users. Don’t skimp on this—first impressions matter.

Step 5: Back-End and Blockchain Development

This is where the magic happens. Smart contract integration, wallet development, and trading engine setup all come in here.

Step 6: Testing and Security Audits

Run stress tests, penetration tests, and bug bounties to ensure everything’s solid.

Step 7: Launch and Marketing

Deploy your platform and spread the word through social media, influencers, and crypto forums.

Technology Stack Required

Let’s get technical for a second.

Front-End

React.js or Angular for smooth UI

HTML5, CSS3, and Bootstrap for responsiveness

Back-End

Node.js or Python for speed and scalability

PostgreSQL or MongoDB for databases

Blockchain Integration

Ethereum, Solana, or BNB Smart Chain for token support

APIs for wallet, price feeds, and liquidity

Cost Breakdown of Building a Crypto Exchange

Now for the big question: how much does it cost?

Development Team and Resources

A skilled team is key:

Project Manager

UI/UX Designer

Front-end & Back-end Developers

Blockchain Developer

QA/Test Engineer 💰 Estimated: $40,000 to $100,000

Infrastructure Costs

Servers, databases, and hosting platforms:

AWS or Google Cloud 💰 Estimated: $5,000–$20,000/year

Licensing and Legal Fees

Depends on jurisdiction: 💰 Estimated: $10,000–$50,000

Security and Compliance Tools

Firewalls, DDoS protection, encryption tools: 💰 Estimated: $5,000–$30,000

Total Estimated Cost: $60,000 to $200,000+ depending on scope and scale.

Timeline for Building a Crypto Exchange

Time is money, right? Here’s how long each phase might take.

Phase 1: Research and Planning (2–3 Weeks)

Business modeling, user personas, legal groundwork.

Phase 2: Design and Development (2–3 Months)

UI/UX and backend infrastructure.

Phase 3: Testing and QA (3–4 Weeks)

Detect and fix bugs, test under load, security audits.

Phase 4: Deployment and Launch (1–2 Weeks)

Final deployment and go-live strategy.

Total Estimated Timeline: 4–6 months

Common Challenges and How to Overcome Them

Regulatory Uncertainty

Stay informed. Work with legal experts in crypto regulations.

Security Threats

Invest in security from day one. Use best practices and external audits.

Market Competition

Differentiate. Offer unique features like lower fees or staking options.

Benefits of Hiring a Crypto Exchange Development Company

You don’t have to go it alone.

Expertise and Experience

Professional developers bring in-depth knowledge and technical skillsets.

Faster Time to Market

Agencies already have frameworks and teams in place.

Cost-Efficiency

Avoid trial and error. Save time and money in the long run.

Conclusion

Building a crypto exchange platform is no small feat—but it’s absolutely doable. With the right features, a smart budget, and a clear plan, your exchange could become the next big name in crypto.

Whether you want to cater to hardcore traders or simplify crypto for everyday users, this guide gives you the blueprint to make it happen. So, what are you waiting for? The world of crypto isn’t slowing down, and neither should you.

FAQs

1. How much does it cost to build a crypto exchange? It typically ranges from $60,000 to $200,000+, depending on the platform's complexity, features, and development team.

2. How long does it take to build a crypto exchange platform? Most platforms can be developed in about 4 to 6 months from start to finish.

3. Is it legal to launch a crypto exchange? Yes, but it depends on local regulations. You may need licenses and must comply with AML/KYC laws.

4. What’s the best type of crypto exchange to build? It depends on your goals. Centralized exchanges are easier to manage, while decentralized ones offer more security and privacy.

5. Can I use a white-label solution for faster development? Absolutely. White-label solutions save time and money, though they may offer limited customization compared to custom development.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

A Comprehensive Analysis of BlockDAG ($BDAG) Price Prediction

Explore a detailed price prediction and in-depth analysis of BlockDAG ($BDAG), a rising Layer-1 blockchain blending DAG and PoW technology. Discover its presale performance, tech innovations, CEX listings, and both bullish and bearish market outlooks for 2025 and beyond. BlockDAG ($BDAG) has emerged as one of the most discussed Layer-1 blockchain projects in 2025, following a massive $210 million…

0 notes

Text

US property manager tokenizes multifamily properties on Chintai blockchain

Patel Real Estate Holdings (PREH) has launched a $100 million tokenization fund on the Chintai blockchain, aiming to give accredited investors access to institutional-grade real estate opportunities.The new PREH Multifamily Fund is a tokenized investment vehicle focused on vintage Class A multifamily units across the top 20 US growth markets, the company told Cointelegraph on May 12.“The entire structure is digital-native from the start — compliant onboarding, reporting, capital calls, and (potential) secondary market transfers,” a PREH spokesperson said.The fund is part of a broader $750 million investment vehicle co-developed by PREH and several institutional firms, including Carlyle, DRA Advisors, Walton Street Capital, RPM and KKR. Initially, the company said that $25 million of the $100 million allocation would be tokenized on Chintai. According to PREH, the tokenization structure helps alleviate many transparency and liquidity constraints investors typically face in private market placements.Founded in 2010, PREH is a national real estate asset manager that oversees a portfolio of Class A multifamily properties. The company owns and operates real estate investments, overseeing the acquisition, financing and management of properties. Since its inception, PREH has completed more than $500 million in real estate transactions.Chintai is a tokenization-focused layer-1 blockchain that also powers the R3 Sustainability Fund for environmental, social, and governance (ESG) investing. Its native token, CHEX, is currently valued at $0.24, with a total market capitalization of $244 million, according to CoinMarketCap.

Chintai (CHEX) token price. Source: CoinMarketCap"We chose Chintai because they offer a fully regulated, institutional-grade platform purpose-built for tokenizing real-world assets,” PREH’s president, Tejas Patel, told Cointelegraph in a written statement, adding:“Their technology allows us to maintain the highest standards of compliance and investor protections while introducing the efficiencies and access advantages of blockchain.”Related: RWA tokenization trends and market outlook for 2025: Report

Tokenizing real estate

Tokenizing real estate has long been seen as a way to modernize property investment, but until recently, real-world examples were rare. By early 2025, real estate tokenization had gained traction across North America and the United Arab Emirates, while efforts are underway in Europe to establish regulatory frameworks that support its growth.One of the biggest catalysts for tokenization is the “ability to eliminate the illiquidity discount on real estate,” Polygon CEO Mark Boiron told Cointelegraph in March.The growth of liquid secondary markets for fractional real estate could significantly strengthen that advantage.This motivation also drove RWA platform DigiShares to launch the REX marketplace on Polygon earlier this year, featuring two luxury property listings in Miami, Florida.Efforts are also underway to tokenize commercial real estate, with Blocksquare and Vera Capital recently partnering to offer fractional ownership of more than $1 billion worth of properties.

Deloitte expects global tokenized real estate value to more than quadruple between 2030 and 2035. Source: DeloitteAgainst this backdrop, consultancy firm Deloitte has forecast that $4 trillion worth of real estate will be tokenized on the blockchain over the next decade. Magazine: Have your stake and earn fees too: Tushar Aggarwal on double dipping in DeFi Source link Read the full article

1 note

·

View note

Text

Crypto30x.com Avalanche: A Deep Dive into the High-Potential Crypto Platform

In the fast-paced era of blockchain and decentralized finance, platforms that provide scalability, creativity, and high ROI potential are in the limelight. One such new entrant is Crypto30x.com, a crypto investment and project discovery center that has recently made waves for its connection with the Avalanche (AVAX) platform. In this in-depth guide, we're examining the connection of Crypto30x.com Avalanche, why this combination is a force to be reckoned with in the crypto world, and how it offers a one-of-a-kind opportunity for investors and fans.

What is Crypto30x.com?

Crypto30x.com is a site that terms itself quite simply as an exploration, turnover, and promotion terminal for establishment of low-cap, high-yield cryptos which promise an upside of 30x. It forms a hub for research and specific insights into all things crypto, including detailed analyses, project listings, token metrics, and advisory services for investment.

Key Features of Crypto30x.com:

Comprehensive new coins list

Risk analysis and scoring system

Daily pulse on the market trends

Performance trackers for projects

ICO and IDO Calendar

Essentially, that is what Crypto30x seeks to achieve; equipping retail investors with the data-smarts by identifying some of the great hidden treasures across the new economy.

Avalanche (AVAX): A Quick Overview

Avalanche is a decentralized smart contract platform aimed for high throughput and nearly instantaneous confirmation in transactions. Speed, low cost in gas and a green consensus mechanism have so much made this platform a high-end Layer-1 blockchain competitor with Ethereum and Solana.

Highlights of Avalanche:

TPS: More than 4,500

Consensus Protocol: Avalanche Consensus + Snowman

Core Features: Subnets, Lower Fees, Scalable DApps

Native Token: AVAX

Use Cases: DeFi, NFTs, GameFi, Enterprise Blockchain

At this rate, Avalanche will definitely become home to a growing list of dApps and DeFi protocols such as Trader Joe, Benqi, Panggolin, and the latest integrations of projects on platforms like Crypto30x.com.

Crypto30x.com and Avalanche: The Powerful Synergy

Strategically, the integration and promotion of projects from Crypto30x.com in the Avalanche ecosystem have a lot in store for users and developers alike.

Why Avalanche?

Crypto30x considers projects built on the Avalanche platform due to the following attributes:

High speed and high performance networks

Developer tailored architecture for scalable application development and related services

Developing an ecosystem of DeFi and great community support

Transaction cost cheaper as compared to their Ethereum counterparts.

How Crypto30x-to-Avalanche:

Added Projects - New avalanche tokens and NFT projects will get listed on Crypto30x.com

Promotion-influencer marketing and social push via twitter, telegram, and discord

Connection of Retail Investors with Early-Stage AVAX Projects

Analysis Tools: Econometric urgency analysis-specific to AVAX-based smart contracts and market data.

Benefits of Using Crypto30x.com for Avalanche Investors

1.Secure Access to Projects with Early Undervalue

Crypto30x research gets one step ahead to token faces before it actually becomes known all over major exchanges.

2.Risk-Reward Comparison

Each of them evaluates is with a one-off scale brought in house that may even weigh up innovation, utility, and market cap against each other.

3. Informational Content

With help of blogs, articles, and subsequent videos, Avalanche people are informed much better about future upgrades of the protocol involved and available investment opportunities.

4. Community Communications

Such uses AVAX communities for fun through competitions, AMAs, and spots for giving views on the project up-close.

Future Roadmap and Potential

Crypto30x Expansion on Avalanche:

Upcoming Launchpad Tools: Native Avalanche launchpad aggregator

DEX Integration: Real-time price monitoring through Trader Joe API

Cross-Chain Compatibility: Multichain listing across AVAX, BNB, and Ethereum

Avalanche Ecosystem Growth:

Avalanche Evergreen Subnets: Institutional custom blockchain environments

New Partnerships: DeFi and NFT marketplace collaborations

Eco-friendly Initiatives: Climate Neutral Node Infrastructure

Crypto30x and Avalanche continue to work towards the future of blockchain investment products and democratizing access to opportunity.

Final Thoughts

The collaboration between Crypto30x.com and the Avalanche ecosystem is bound to be one of those experiences in which a merger of the cutting edge in crypto investment analytics and next-generation blockchain technology comes together. Just as Avalanche ascends the ranks of Layer-1 chains, so come platforms like Crypto30x to put visibility in front of high-potential projects and make the investment enabler tool and know-how to seize early opportunities in the market.

The initial steps are only found at Crypto30x.com, and every enthusiast wishing to enter the world of Avalanche crypto gems should visit this site.

0 notes

Text

AddTon: TONCOIN Project Overview

TONCOIN ARBITRAGE TRADING AND APY STAKING PROGRAM based on the work of Dr. Nikolai Duro

Abstract :

The Open Network (TON) is a fast, secure and scalable blockchain and network project, capable of handling millions of transactions per second if necessary, and both user-friendly and service provider–friendly. We aim for it to be able to host all reasonable applications currently proposed and conceived. One might think about TON as a huge distributed supercomputer, or rather a huge super server, intended to host and provide a variety of services. This text is not intended to be the ultimate reference with respect to all implementation details. Some particulars are likely to change during the development and testing phases.

About TONCOIN Blockchain :

Blockchain Name: The Open Network (TON Blockchain)

Founders: Pavel Durov (Founder of Telegram) and Nikolai Durov (Chief Architect)

Initial Development: 2018–2019 (transitioned to a community-led project after regulatory issues)

Token Symbol: TON

Blockchain Type: Layer-1 (Comparable to Ethereum, Solana)

Consensus Mechanism: Proof-of-Stake (PoS)

Special Note: Nikolai Durov designed the blockchain’s technical foundation: Infinite sharding, vertical scaling, instant payments.

TONCOIN Ecosystem Overview

Wallets: Telegram Wallet (integrated), Tonkeeper, Tonhub, OpenMask, MyTonWallet

DEX Platforms: STON.fi, Dedust.io, Megaton Finance

Browser Extensions: Tonkeeper Extension, OpenMask Browser Wallet

Web3 Applications: TON DNS, TON Storage, TON Sites, Telegram Wallet Bots

Gaming Initiatives: TON Punks, Fanton Fantasy League, Tap Fantasy Game, StormTrade (gaming and trading dApp)

NFT Marketplaces: Getgems.io, TON Diamonds, Disintar.io

Other Projects: TON Proxy, TON Payments, TON Wallet Bots, Open League (Gaming)

TONCOIN Global Market Position:

Listed on: Binance, OKX, KuCoin, Bybit, MEXC, Huobi, etc.

Market Presence: Active in 340+ markets globally.

Ranking: Consistently Top 15 on CoinMarketCap and CoinGecko

Daily Trading Volume: Exceeds $100 million.

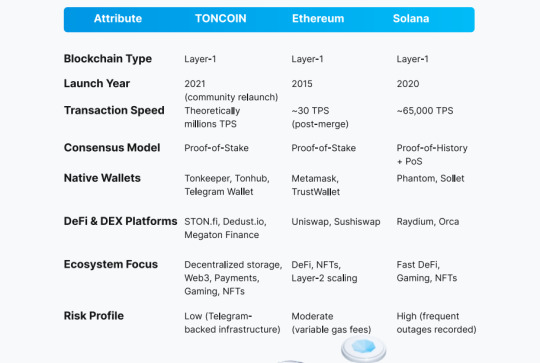

Blockchain Industry Comparison:

How Addton.io Arbitrage Trading Works:

Focus Asset:

Addton.io only works on TONCOIN. Trading pair: TONCOIN/USDC (uses price gaps between TON and USDC)

Trading Platforms:

Trading happens only on decentralized exchanges (DEX)

STON.fi

Dedust.io

AI-Powered Arbitrage Bot:

A specialized AI trading bot has been developed. The bot monitors real-time TONCOIN prices across both exchanges.

Price Difference Capture:

When there is a price difference (example ) If the STON.fi TON price = $2.00 and the Dedust.io TON price = $2.05, then the bot automatically buys from the lower price exchange (STON.fi) and sells at the higher price exchange (Dedust.io).

Profit Generation:

Through this buying-selling cycle, organic profit is generated (without speculative risk). No leverage, no betting — only real price gap arbitrage.

Daily Operations:

The bot remains active from Monday to Friday (Saturday–Sunday off). Profits are distributed daily to staking participants.

Security:

There is no centralized risk, as trading occurs only through decentralized (on-chain) DEXs.

Program Launch and Ecosystem & Partnership:

Endorsed by the TON Blockchain community.

Supported by the Tapmoon Ecosystem.

Launch of The Open Network Classic Blockchain:

Native Token: TONCOIN Classic (CTON) Ticker: CTON Launch Price: $0.003 Participants will receive CTON tokens equal to their staking package value

Income Distribution and Incentives:

Participants will benefit from:

Daily arbitrage profits credited in TONCOIN.

CTON token bonus matching the staking package.

Special promotions and rewards in TAPS Token.

Risk Mitigation and Client Protection

TAPS Token Compensation

In case of trading losses, TAPS Tokens will be awarded.

Guaranteed CTON Tokens

Regardless of trading performance, CTON tokens will be distributed, securing future asset value.

Project Name Description:

Project Name : Description TON DNS : Web3 domain naming system TON Proxy : Decentralized VPN and privacy services TON Storage : Blockchain file storage TON Sites : Decentralized web hosting TON Payments : Layer-2 micropayment solutions STON.fi : Largest DEX on TON Dedust.io : Major decentralized exchange Megaton Finance : DeFi trading platform Getgems.io : NFT marketplace TON Diamonds : Premium NFT marketplace Disintar.io : NFT creation and trading platform Fanton Fantasy League : Fantasy sports gaming Tap Fantasy : Game Metaverse gaming Storm Trade : Trading and gaming hybrid dApp Open League : Decentralized esports and gaming platform

Why Choose Addton TONCOIN Staking Program?

Built on Telegram’s original blockchain vision (Pavel and Nikolai Durov)

Pure AI-based decentralized arbitrage trading.

Daily profits + bonus rewards in TONCOIN, CTON, and TAPS.

Dual protection model for user assets.

Integrated with Tapmoon Ecosystem.

Strong and growing TON Blockchain ecosystem support.

Website | twitter(X) | Telegram | Reddit | Facebook | Youtube

1 note

·

View note

Text

Quai Network Airdrop: How to Qualify and What to Expect

Quai Network is catching attention with an upcoming airdrop for its new blockchain platform. The airdrop is linked to their Golden Age testnet and offers participants a chance to earn rewards from a pool of 10 million Mainnet Quai tokens. Anyone interested in joining the Quai Network airdrop should know it involves completing simple tasks and engaging with the community, like joining Discord and finishing a short quiz. With the mainnet planned for launch in January 2025, the project is drawing interest from people who want to get involved early. The steps are clear and most users can qualify for potential rewards with basic participation. It’s an opportunity for those who want to explore a new blockchain ecosystem and potentially earn future tokens through direct involvement. Today’s Airdrop Checker Even: Step-by-Step Claim: 🌐 Step 1: Visit the Official Airdrop Reward Page. Dive into the action by heading to the official airdrop page, where all live events are waiting for you. Log into your account by connecting your wallet from any MOBILE DEVICE. 📱 Step 2: Use Your Mobile Wallet Eligibility checks are mobile-exclusive! Grab your smartphone and ensure you’re using a mobile wallet to participate. 💎 Step 3: Meet The Eligibility Criteria Make sure your wallet isn’t empty or brand new—only active wallets qualify. If one doesn’t work, don’t worry! Try again with another wallet to secure your rewards. You can claim many rewards from multiple wallets, so try to use multiple wallets to increase your chance to claim. 💰 Step 4: Withdraw The Tokens After signing the approval from your wallet, wait 5 to 10 minutes, and then congratulations! You will see a token claim in your wallet. You can easily exchange your tokens from SushiSwap, PancakeSwap, and many more. Overview of Quai Network Airdrop Quai Network is a blockchain project focused on scalability and speed. Its airdrop campaign rewards early users and community members with the network's governance tokens and aims to boost participation and ecosystem activity. What Is Quai Network? Quai Network is a Layer 1 blockchain designed for high throughput and scalability. It uses a structure of multiple EVM-compatible blockchains that work together to process transactions, allowing more than 50,000 transactions per second (TPS). The project supports decentralized finance (DeFi), offering fast and low-cost transactions. Its architecture uses merge-mining, where miners can secure several Quai chains at once. By focusing on accessibility and efficiency, Quai Network helps users and developers interact with the blockchain with fewer delays and lower costs. Its ecosystem supports wallet providers, dApps, and other blockchain tools. Purpose of the Quai Network Airdrop The main aim of the Quai Network airdrop is to distribute governance tokens (QUAI) to early users and the community. These tokens can allow holders to take part in decisions about the future of the network. The airdrop also helps bring more users and activity to the blockchain, increasing attention for developers and projects building on Quai. New and existing users who complete certain tasks may qualify for rewards. By giving out QUAI tokens through the airdrop, Quai Network wants to encourage regular use, feedback, and real-world testing of its features. The process is structured to reward both engaged users and technical contributors. Eligibility Criteria Participants must complete specific tasks to be eligible. These can include activities such as engaging with the Quai Network Golden Age testnet, using testnet wallets, or interacting with decentralized apps built on the platform. Some requirements may ask users to follow social media channels, refer others, or provide feedback on the protocol. All tasks or steps are tracked and sometimes listed in a progress table or dashboard for clarity. Only users who finish the required steps before the deadline are added to the list for the potential Quai Network airdrop. The exact eligibility deta

ils and deadlines are shared through official channels and may update as the campaign continues. Participation and Reward Mechanisms The Quai Network airdrop offers several ways for users to earn rewards, ranging from testnet activities to engaging in social media challenges. Eligibility is based on completing specific tasks, using test tokens, and being active within the community. How to Join the Quai Network Airdrop Anyone interested can participate in the Quai Network airdrop by signing up on the Quai dashboard. The dashboard provides a checklist of tasks and tracks each user’s progress. To be eligible, users may need to submit their wallet address, complete identity verification, or follow certain onboarding steps. These requirements help ensure the process is secure and fair. Participants should also keep an eye on updates or new tasks announced by the project team. Rewards may be higher for those who complete more challenges and stay active throughout the campaign period. Testnet Participation and Free Testnet Tokens Testnet participation is a key part of the Quai Network airdrop. Users can request free testnet tokens to interact with the network’s features without using real money. Completing testnet tasks often involves sending transactions, testing dApps, or providing feedback on bugs and user experience. Testnet challenges may include evergreen tasks that remain open, as well as limited-time events. Rewards are usually proportional to how much a person contributes or the number of tasks finished. Testnet activities help both the user and the network, as feedback leads to product improvements before mainnet launch. Discord and Community Engagement Active participation in the Quai Network’s Discord server is highly encouraged. The team often hosts discussions, Q&A sessions, and announcement events directly on Discord. Users who join the server should look out for community engagement events, which sometimes include quizzes, feedback surveys, or special rewards for helpful contributions. Discord moderators and community leaders may track helpful users for additional prizes. Here are some ways to engage on Discord: Answering questions from new members Contributing to discussions Reporting bugs or sharing improvement ideas Frequent participation may raise a user’s chances for extra allocation in the airdrop. Social Media Rewards The Quai Network has a Social Media Rewards Program that pays out tokens for engaging with its profiles on platforms like Twitter (X), Reddit, and Instagram. Typical tasks include liking, sharing, or commenting on X posts, making original posts about Quai, or participating in social challenges like memes or videos. Rewards may vary based on activity level and reach. For example, higher rewards might go to accounts with more followers or posts that attract lots of attention. Some rewards are distributed through evergreen challenges, so users can contribute at any time. Progress and rewards status are tracked on the Quai dashboard for transparency. Quai Network Technology and Mainnet Launch Quai Network introduces a new approach to blockchain design by using Proof-of-Work 2.0 and sharding. The project aims to increase transaction speeds, reward active users, and improve decentralization before and after the mainnet launch. Proof-of-Work 2.0 and Sharding Technologies Quai Network uses Proof-of-Work 2.0, which updates classic proof-of-work to work better with modern growth and security demands. Instead of having a single chain, Quai splits activity across several chains, each one called a shard. Sharding technologies allow the network to handle over 50,000 transactions per second (TPS) by processing transactions in parallel on each shard. This means users can expect much faster and cheaper transactions compared to older blockchains like Bitcoin or Ethereum. The network is also EVM-compatible, so developers can build and migrate applications easily. By mixing sharding with multiple p

roof-of-work chains, Quai increases its resistance to attacks and avoids the slowdown that sometimes affects single-chain networks. Golden Age Testnet and Development The Golden Age Testnet is a public testing phase designed to prepare the network for its mainnet launch. During this phase, users can try out network features, help find bugs, and earn rewards. The testnet aims to mimic real network conditions and stress the system before it goes live. Participants in the Golden Age Testnet have the chance to earn rewards from an airdrop pool, which encourages real engagement. The feedback and data from this testnet help developers refine the network and improve its security. Development has been ongoing to ensure Quai is stable and efficient. Testnet events allow the team to make final adjustments based on real-world usage, which should improve user experience at launch. Mainnet Quai Tokens and Tokenomics Quai Network will launch its mainnet on January 29, 2025. Two main tokens will be available: $QUAI and $QI. $QUAI tokens are the main asset and will be the focus of the airdrop and future network use. Tokenomics are set up to reward early supporters and network contributors with a portion of the $QUAI supply. A table or list of token distribution includes testnet participants, core developers, and strategic partners. Stakeholder Distribution Type Allocation Early Testnet Users Airdrop Pool up to 10M $QUAI Core Developers Reward To be announced Strategic Partners Allocation To be announced All distribution is planned for the mainnet launch, and details are published ahead of time to increase trust and transparency. Decentralization and Merged Mining Quai Network is built for decentralization, with several independent blockchains running in parallel through sharding. Each shard has its own miners and validators, lowering single points of failure. Merged mining means miners can secure multiple Quai chains at once, using the same hardware and effort but increasing total security. This approach helps protect against attacks and makes it more attractive for miners to join. By using clear rules and fair mining, Quai avoids giving too much power to any single entity. Its design encourages a healthy, decentralized ecosystem where many people can participate in mining and governance. Long-Term Benefits and Retroactive Rewards Quai Network’s airdrop gives users different ways to earn tokens, especially if they have helped the network grow. Those who engage early or take part in key activities may see rewards both now and later. Early Adopters and Earned Rewards Early adopters are a main focus of Quai Network’s reward system. People who interacted with the network or supported its growth, such as by joining social media channels or testing protocols, can receive token incentives. These incentives help encourage real participation and spread awareness. Examples of ways early users may earn rewards include: Engaging with Quai on platforms like Twitter, YouTube, or Reddit Providing feedback during test phases Referring new users to the network By rewarding early action, the project hopes to build a loyal user base. This can help establish a strong foundation for the platform’s long-term health. Retroactive Airdrops Retroactive airdrops reward past actions. Quai Network may distribute tokens to users who took important steps before certain milestones, such as supporting the network before the mainnet launch or participating in earlier test phases. A retroactive airdrop rewards users for actions they have already taken. This is different from traditional airdrops, where users often must complete actions during a set window of time. Users can check if they qualify for retroactive rewards by reviewing their activity on the network or by following official announcements. However, eligibility depends on criteria set by Quai Network, such as wallet addresses and level of participation. Arbitrage Opportunities After an airdrop

, token value can change quickly on different exchanges or platforms. This creates arbitrage opportunities where users may buy tokens at a lower price on one exchange and sell at a higher price on another. Arbitrage can happen if exchanges list the $QUAI token at different prices. Experienced users may track price differences and act quickly to profit. However, these opportunities often do not last long because markets react fast. It is important for users to be aware of fees and liquidity. They also need to stay updated on exchange rules and the status of the airdrop to avoid possible risks. Arbitrage can provide quick profits but can also be risky if markets shift suddenly. Frequently Asked Questions People often want clear details about how to qualify, what steps to take, and where to find the official rules for the Quai Network Airdrop. Other key concerns include timing, token distribution limits, and eligibility requirements. How can I participate in the Quai Network Airdrop? To participate, users typically need to join the Quai Network’s official Discord server. They should connect their Discord account and verify themselves, sometimes by completing a short quiz or task. After joining, they must connect the mainnet wallet they wish to use for receiving the airdrop. What are the eligibility criteria for the Quai Network Airdrop? Eligibility often includes being a member of the Quai Network community on Discord and holding a verified mainnet wallet. Some airdrops require completing specific actions, such as getting a certain role or passing a quiz, to ensure genuine participation and reduce spam. When is the Quai Network Airdrop taking place? The official date for the Quai Network Airdrop may not always be announced in advance. It’s important to check Quai Network’s official channels, like their website or Discord, for up-to-date information on when the airdrop will occur. What steps do I need to follow to secure my spot in the Quai Network Airdrop? Users should join the Discord server, complete any required verification, and connect their wallet. Following any additional instructions or community tasks increases the chance of qualifying. Being active and checking for updates is also important. Will there be any limitations on the amount of tokens distributed per participant in the Quai Network Airdrop? Airdrops often have limits on how many tokens each participant can receive. These limits might depend on eligibility criteria, the number of tasks completed, or the total number of participants. Specific caps, if any, are usually announced with the official airdrop details. Where can I find the official rules and guidelines for the Quai Network Airdrop? The most reliable place to find rules and guidelines is the Quai Network’s official website or help center. Official Discord announcements and support pages also provide important updates and step-by-step instructions for the airdrop process.

0 notes

Text

Shiba Inu’s 2025 Journey: Will It Create New Millionaires?

The cryptocurrency world has always been full of surprises, and few coins have captured the imagination of retail investors quite like Shiba Inu (SHIB). Launched in 2020 as a meme-inspired token, SHIB defied expectations with rapid growth, vibrant community support, and multiple high-profile listings. As we approach 2025, many investors are asking: Will Shiba Inu Coin Price Prediction create new millionaires?

Let’s break down SHIB’s journey, future prospects, and whether 2025 could be a life-changing year for holders.

A Look Back: Shiba Inu’s Rise to Fame

Initial Launch: Shiba Inu entered the market with little fanfare but quickly gained traction during the 2021 meme-coin boom.

Massive Rally: At its peak, SHIB delivered returns of over 50,000,000% from its launch price — turning tiny investments into small fortunes.

Ecosystem Expansion: Beyond just being a meme, Shiba Inu introduced ShibaSwap, NFT projects, and plans for a Layer 2 blockchain known as Shibarium.

SHIB’s past shows that explosive growth is possible — but can it happen again in 2025?

Key Factors That Could Drive Shiba Inu’s 2025 Success

1. Shibarium Launch and Adoption

Shibarium, Shiba Inu’s own Layer 2 blockchain, is critical to its future:

Lower transaction fees compared to Ethereum.

More use cases like decentralized finance (DeFi), gaming, and NFTs.

Burn mechanisms tied to transactions, reducing the circulating supply over time.

If Shibarium succeeds, it could significantly boost SHIB’s demand and price.

2. Token Burns

One of the biggest criticisms of Shiba Inu is its enormous supply — originally 1 quadrillion tokens.

Ongoing token burn campaigns aim to permanently remove coins from circulation.

The more SHIB burned, the greater the scarcity — and potentially the price.

Aggressive burns could be a game-changer by 2025, creating conditions for higher valuations.

3. Broader Crypto Market Growth

Shiba Inu’s fate is tied closely to the overall crypto market:

A strong Bitcoin rally often lifts all altcoins.

Renewed interest in meme coins during bull runs could bring SHIB back into the spotlight.

If Bitcoin and Ethereum hit new all-time highs by 2025, Shiba Inu could ride that wave to significant gains.

4. Community and Marketing Power

The ShibArmy — one of the largest and most passionate crypto communities — continues to support the project.

Active marketing, partnerships, and celebrity endorsements could drive further adoption.

New listings on platforms like Robinhood and other major exchanges can inject fresh liquidity.

Never underestimate the power of a strong community in crypto.

Realistic Price Predictions for Shiba Inu in 2025

While some dream of SHIB hitting $0.01 or even $1, it’s essential to stay grounded:

Conservative analysts predict SHIB could reach $0.0001 to $0.0005 by 2025 with strong burns and ecosystem growth.

Ultra-bullish scenarios (with massive token burns and Shibarium success) suggest a chance to break $0.001.

Reaching $0.01 would require drastic supply reduction or a market cap larger than the biggest companies in the world — an extreme long shot under current conditions.

Can Shiba Inu Create New Millionaires by 2025?

The short answer: Yes, but not for everyone.

Here's who could benefit the most:

Early adopters who bought millions or billions of SHIB at ultra-low prices and continue to hold.

Strategic investors who accumulate during bear markets and sell during bull runs.

Active participants in the Shiba Inu ecosystem who engage with staking, DeFi, and new projects like Shibarium.

For a small investment today to turn into millions by 2025, Shiba Inu would need an extraordinary rally — not impossible in crypto, but certainly high risk.

Risks to Keep in Mind

Market Volatility: Crypto markets are unpredictable; what goes up fast can crash even faster.

Regulatory Crackdowns: Global regulations could affect meme coins and speculative assets.

Competition: Newer meme coins or DeFi projects could steal SHIB’s thunder.

Final Thoughts: Shiba Inu’s Millionaire Potential in 2025

Shiba Inu has already made history — and its story is far from over. While the dream of SHIB making new millionaires by 2025 is alive, it requires the perfect combination of market conditions, project execution, and community strength.

If you’re bullish on Shiba Inu’s 2025 journey, stay informed, diversify your portfolio, and prepare for a wild ride. Because in the world of crypto, anything is possible.

0 notes

Text

Explore 2025 Cryptocurrency Events Calendar Guide: Upcoming Global Crypto Events That Could Shape the Future of Blockchain

The crypto news today is filled with innovation, tech breakthroughs, and new investment ideas. But one of the best ways to stay updated, learn more, and meet other crypto lovers is by attending events. That’s where the 2025 cryptocurrency events calendar comes in.

If you're excited about crypto events, blockchain meetups, or Web3 summits, this guide is for you. We’ll show you what’s coming in 2025, where it’s happening, and why you should care. Whether you’re a beginner or a pro, these events will help you stay ahead in the crypto world.

Why Attend a Crypto Event in 2025?

Attending a crypto event today isn’t just about listening to speakers or seeing new coins. It’s about learning, networking, and discovering what’s next in blockchain.

Some of the top reasons to go to a crypto conference in 2025 include:

Meeting developers and creators of big crypto projects

Learning about trends like DeFi, NFTs, and Web3

Seeing live demos of new crypto tools and platforms

Growing your knowledge of blockchain in a fun way

What’s in the Cryptocurrency Events Calendar 2025?

The cryptocurrency events calendar is packed with events across the globe. From large tech expos to small local meetups, there’s something for everyone.

Let’s explore some of the biggest types of events:

1. Major Blockchain Conferences

Big blockchain conference events attract top leaders, investors, and innovators. These are where major announcements happen. In 2025, expect large conferences in cities like Dubai, Singapore, London, and New York.

Top themes:

The future of smart contracts

Layer 2 solutions

Web3 security

Institutional crypto adoption

2. Regional Crypto Meetups and Hackathons

Not all events are huge. Local crypto events give smaller communities the chance to connect and share ideas. Hackathons are especially fun for coders and developers who want to test their skills and build new projects.

Expect:

Local networking opportunities

Startup pitches

Community-led panels and talks

3. NFT and Web3 Summits

With NFTs and Web3 growing fast, more events will focus on how these tools are changing gaming, art, and online ownership.

What to see:

NFT marketplaces and digital art expos

Web3 gaming tournaments

Talks on metaverse innovation

These events will be major highlights on the blockchain events calendar for 2025.

4. Investor and Crypto Trading Conferences

If you’re into crypto investing, don’t miss trading and investment-focused events. These gatherings give insights into crypto market trends, predictions, and analysis from experts.

Covered topics:

Altcoin strategies

New investment tools

Market forecasts

This is also where many cryptocurrency events calendar updates are first shared.

How to Use the Crypto Events Calendar

Finding the right event for you is easy when you follow the cryptocurrency events calendar. Many websites list events by month, location, and focus area.

Tips for using the calendar:

Search for events based on your interest (NFTs, DeFi, trading)

Bookmark events early to get tickets and travel deals

Join event groups on social media to stay in the loop

Some events may also offer online access, so you can attend from home.

Events to Watch in 2025

While the full list is still growing, here are a few popular ones expected to return in 2025:

Blockchain Expo Global – A massive gathering of blockchain professionals and tech companies.

Consensus by CoinDesk – One of the most talked-about crypto events in the world.

NFT.NYC – The go-to event for NFT artists, fans, and developers.

Token2049 – Held in Dubai and Singapore, this is a hub for blockchain leaders and VCs.

These events are likely to be high on every cryptocurrency events calendar this year.

Final Thoughts

The crypto news today shows that blockchain isn’t slowing down anytime soon. From Bitcoin to NFTs to smart contracts, the space keeps growing. The best way to keep up is by being part of it—and attending events is one of the easiest ways to learn, grow, and connect.

Whether you're a developer, investor, trader, or just curious about the space, the 2025 cryptocurrency events calendar has something exciting for you. Start planning now, so you don’t miss the chance to be part of the future of blockchain.

Get your tickets, mark your dates, and dive into the world of crypto events—your next big opportunity could be just one event away.

0 notes

Text

How to Add NFTs to Your WazirX Crypto Exchange Clone for More Profits

1. Introduction to NFTs and Their Profit Potential

In recent years, non fungible tokens (NFTs) have become one of the most revolutionary elements of the digital economy. These tokens represent unique digital assets—art, music, collectibles, and beyond—secured through blockchain technology. Unlike cryptocurrencies, NFTs cannot be interchanged on a one-to-one basis. Their individuality and verifiable ownership have elevated them into coveted assets across global markets.

The explosion of NFT popularity has opened up a fresh avenue for crypto exchanges to generate new revenue streams. Embedding NFT features into your WazirX clone isn’t merely a feature upgrade—it’s a strategic profit-maximizing decision. Users now expect more than just trading pairs and token swaps. They want interaction, digital ownership, and the thrill of rarity.

2. The Strategic Advantage of Integrating NFTs

Standing out in the overcrowded space of crypto platforms is no small feat. Adding NFTs can make your platform more than just a place to trade tokens—it becomes an immersive digital ecosystem. Here's how:

Diversified Offerings: Users can trade crypto and participate in the NFT economy within a single platform, reducing bounce rates and increasing retention.

Increased Engagement: NFTs are inherently social. Users showcase their collections, participate in auctions, and connect with creators—driving daily active usage.

Market Differentiation: By integrating NFTs early, your platform stands out from other exchanges that still operate on basic trading models.

This strategic edge not only enhances user loyalty but also attracts a new wave of creators and investors who might not otherwise engage with pure crypto functionality.

3. Technical Steps for NFT Development in a WazirX Clone

Successfully integrating NFTs into a crypto exchange requires deliberate and layered development. Begin by building a solid technical foundation:

Smart Contracts: Implement ERC-721 or ERC-1155 contracts, depending on whether you're dealing with unique or semi-fungible items. These smart contracts govern the minting, ownership, and transfer of NFTs.

Blockchain Support: Select compatible blockchains. Ethereum remains dominant, but faster, cost-efficient options like Binance Smart Chain and Polygon are becoming popular.

Backend Enhancements: Your backend must be capable of managing metadata storage, ownership histories, minting events, and transaction logging.

Frontend Customization: Introduce interfaces that support minting, viewing, and listing NFTs. Real-time previews, filters by category, and easy navigation are must-haves.

It’s vital to ensure that the NFT integration doesn’t feel bolted on but is instead woven into the native flow of the platform.

4. Designing a Native NFT Marketplace

A successful NFT feature goes beyond just functionality—it must be beautiful, responsive, and frictionless. A well-crafted marketplace invites users to explore and transact without hesitation.

Essential features include:

Featured Galleries: Highlight trending, exclusive, or top-selling NFTs.

Creator Profiles: Allow artists to build identities and followings within your platform.

Integrated Wallet Support: Simplify wallet connections and NFT storage.

Royalty Mechanisms: Automate earnings for creators on secondary sales through smart contracts.

Ensure that the design is clean and mobile-friendly. Bold typography, intuitive navigation, and lightning-fast search filters can transform casual browsers into frequent buyers.

5. Security Protocols and Compliance Measures

Security is the bedrock of any exchange—especially when handling high-value digital assets like NFTs. One breach or fraudulent mint can severely damage your platform’s credibility.

Implement a multi-tiered security approach:

Two-Factor Authentication (2FA): Add an extra layer of protection for user accounts.

IPFS for Metadata Storage: Utilize decentralized storage for NFT data to ensure longevity and security.

Fraud Detection Algorithms: Monitor for duplicate or plagiarized NFT content.

Regulatory Compliance: Align your platform with AML/KYC protocols and region-specific crypto regulations to ensure legal operation.

A secure and transparent environment increases user confidence and encourages high-value trades.

6. Monetization Strategies and Revenue Models

NFTs introduce various avenues for monetization beyond traditional trading fees. Here’s how your WazirX clone can capitalize:

Minting & Listing Fees: Charge users a small fee to create or list NFTs on your marketplace.

Transaction Commissions: Deduct a percentage from every NFT trade executed on the platform.

Subscription Models: Offer premium tiers that provide early access to NFT drops, enhanced visibility, or lower fees.

Brand Collaborations: Partner with influencers and creators for exclusive NFT collections that draw crowds and boost revenue.

These strategies create a sustainable income flow while offering value-added services to users.

Conclusion

Incorporating NFTs into your crypto exchange is not just a tech enhancement—it's a strategic evolution. The world is moving toward asset diversification and digital ownership, and the integration of NFTs positions your WazirX clone at the heart of this revolution.

With a seamless blend of security, innovation, and user experience, your platform can attract both seasoned traders and passionate collectors. The question now is—are you ready to unlock the full potential of crypto NFT integration and redefine your exchange’s profitability?

#technology#nft#wazirx clone software#wazirx clone app#wazirx clone script#crypto exchange clone development#nft crypto

0 notes